how to calculate my paycheck in michigan

Adjusted gross income - Post-tax deductions Exemptions Taxable income. Capital gains in Michigan are taxed as regular income at the state rate of 425 though certain local jurisdictions may charge more.

Understanding Your Paycheck Human Resources University Of Michigan

Michigan Capital Gains Tax.

. Choose if you are an HOURLY worker or a SALARY worker. Rates range from 006 to 103 of each employees income up to a wage base of 9500. Select Start date on Calendar.

Michigan allows employers to pay 425 per hour for the first 90 days to train new employees aged 16 to 19. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404.

Heres a step-by-step guide to walk you through the tool. Michiganders currently pay a gas tax of 2630 cents per gallon. In Michigan overtime hours are any hours over 40 worked in a single week.

How Your Michigan Paycheck Works. Michigan does not have an estate or inheritance tax. On the W-4 form you file with your employer you indicate how much your employer should withhold from your paychecks.

The tax for diesel fuel is. A salaried employee is paid an annual salary. Secretary of State - On-line Plate Fee Calculator is.

Next divide this number from the annual salary. The median household income is 54909 2017. The Michigan Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Michigan State Income Tax Rates and Thresholds in 2022.

It can also be used to help fill steps 3 and 4 of a W-4 form. Local income tax ranging from 1 to 24. These calculators are not intended to provide tax or legal.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Lets say the annual salary is 30000. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Taxable income Tax rate based on filing status Tax liability. This includes just two items.

This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Michigan hourly calculator. Total annual income - Tax liability All deductions Withholdings Your annual paycheck.

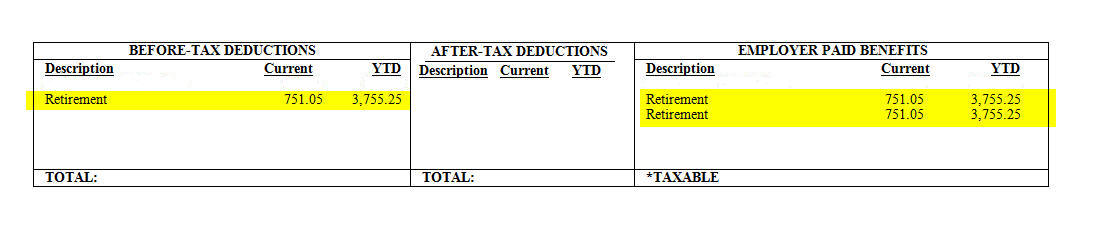

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Michigan. The Yellow Highlight is the days worked in the DATES WORKED calendar in BOX-4.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. The GROSS will be calculated for you. How to calculate my paycheck in michigan.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This number is the gross pay per pay period. Plus you also need to factor in Michigans state unemployment insurance SUI.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local w4 information. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s. Supports hourly salary income and multiple pay frequencies.

If you pay salaried employees twice a month there are 24 pay periods in the year and the gross pay for one pay period is 1250 30000 divided. Employers must report new or rehired employees within 20 days of hire through the Michigan New Hires Operation Center. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

The income tax is a flat rate of 425. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. You can pay employees aged 16 to 17 at 85 of the minimum wage.

Hourly Paycheck Calculator Calculate Hourly Pay Adp Indicates that the amount is your annual salary. This free easy to use payroll calculator will calculate your take home pay. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Then how often you are paid. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Important Note on Calculator. Michigan Overtime Wage Calculator. Details of the personal income tax rates used in the 2022 Michigan State Calculator are published below the.

Things like your marital status and the number of dependents you have all affect how much your employer withholds. Their name and the state where they live. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate.

Click the calculate paycheck button. It should not be relied upon to calculate exact taxes payroll or other financial data. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

How to calculate annual income. Your employer also withholds money to pre-pay your federal income taxes. Fill in the employees details.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. But these cities charge an additional income tax ranging from 15 to 24 for Michigan residents. How do I calculate hourly rate.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This calculator is intended for use by US. Company data must be accurate to be represented on the Paystub.

SmartAssets Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes. Switch to Michigan salary calculator. Michigan Tipped Wage Calculator.

Michigan has a population of over 9 million 2019 and is widely known as the center of the United States automotive industry with the Big Three all headquartered in Detroit. If your business is new the unemployment tax rate is set at 27. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Understanding Your Pay Statement Office Of Human Resources

Michigan Paycheck Calculator Updated For 2022

Michigan Paystub Generator Thepaystubs

Successaesthetics Bullet Journal Inspiration Bullet Journal Journal Inspiration

Paycheck Calculator Michigan Mi Hourly Salary

Understanding Your Paycheck Human Resources University Of Michigan

Free Michigan Payroll Calculator 2022 Mi Tax Rates Onpay

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

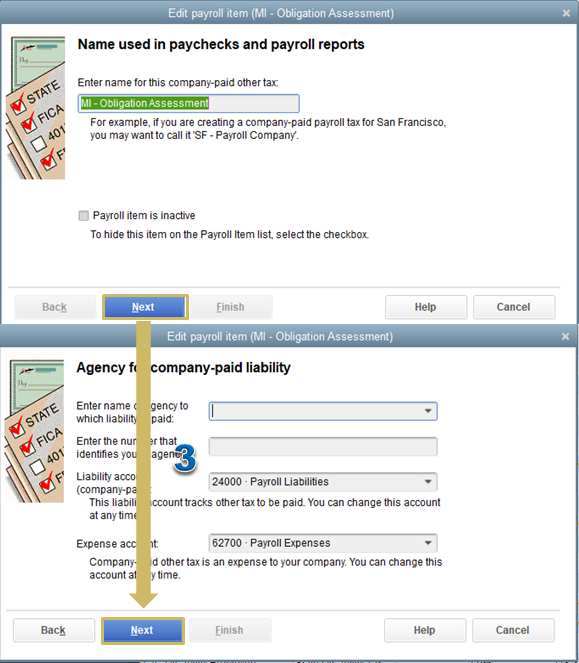

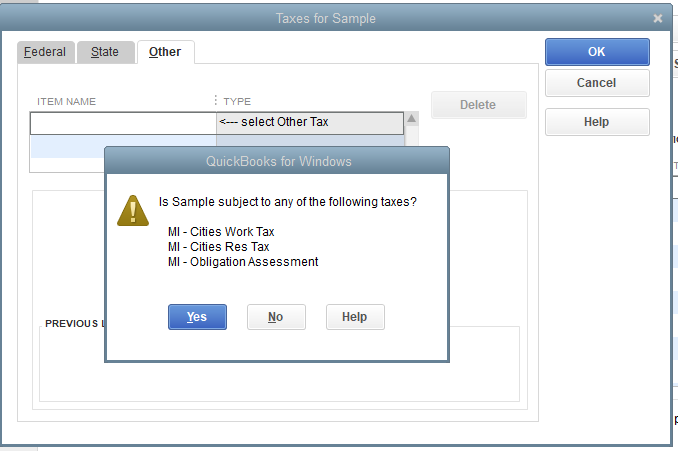

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Michigan Sales Tax Calculator Reverse Sales Dremployee

Michigan Paycheck Calculator Adp

Michigan Salary Calculator 2022 Icalculator

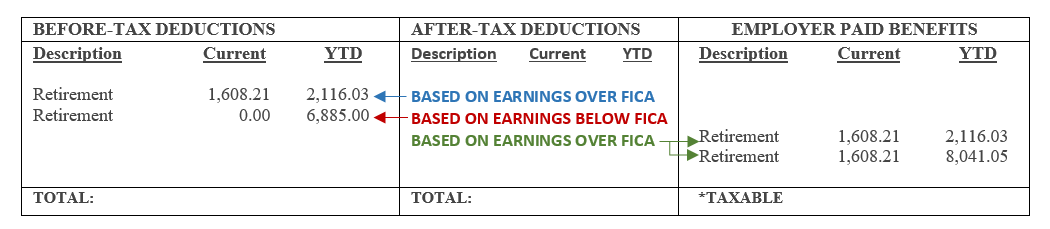

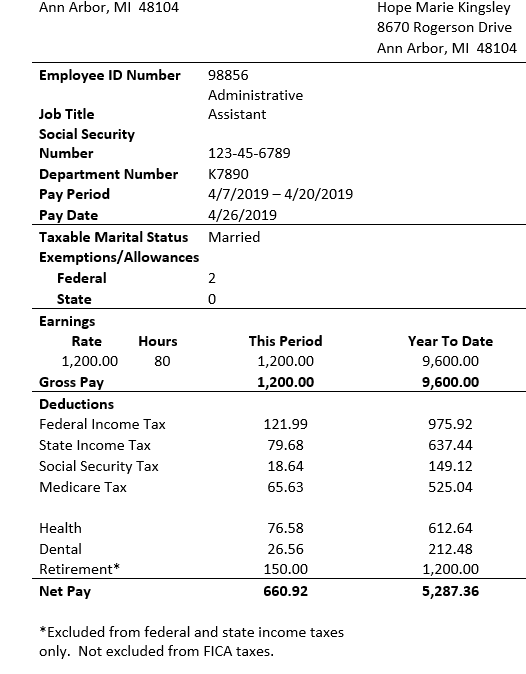

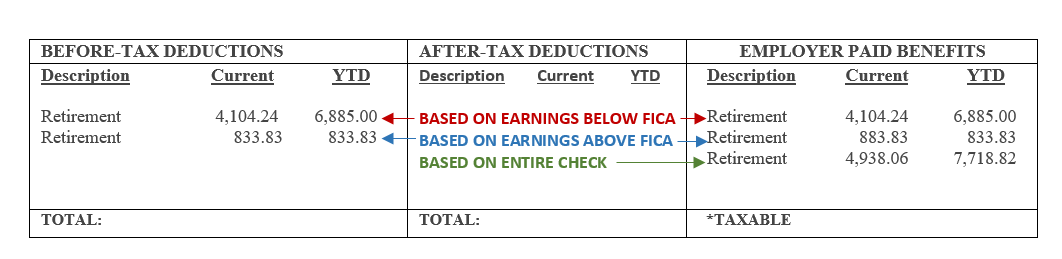

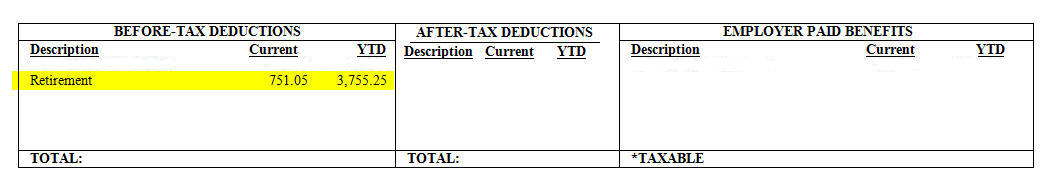

For The Federal And State Taxes The Retirement Is Chegg Com

Michigan Salary Paycheck Calculator Paycheckcity

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Understanding Your Paycheck Human Resources University Of Michigan

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Understanding Your Paycheck Human Resources University Of Michigan