avalara tax code matrix

Send Avalara a list of items you sell so Avalara can map them to Harmonized System HS tariff codes. Avalara Tax Research 2 min.

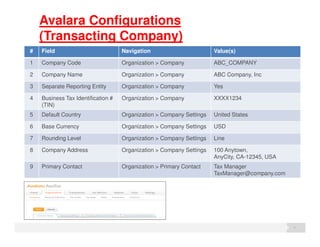

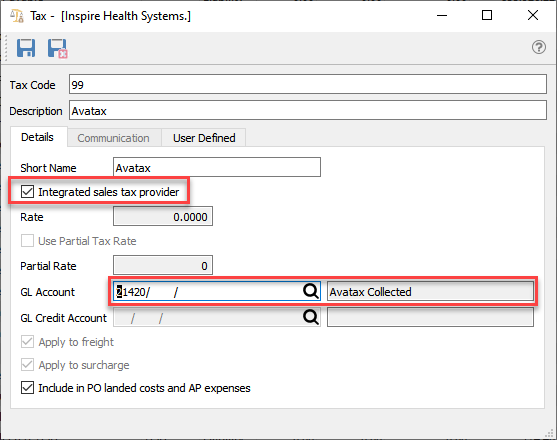

Avalara Sales Tax Spire User Manual 3 5

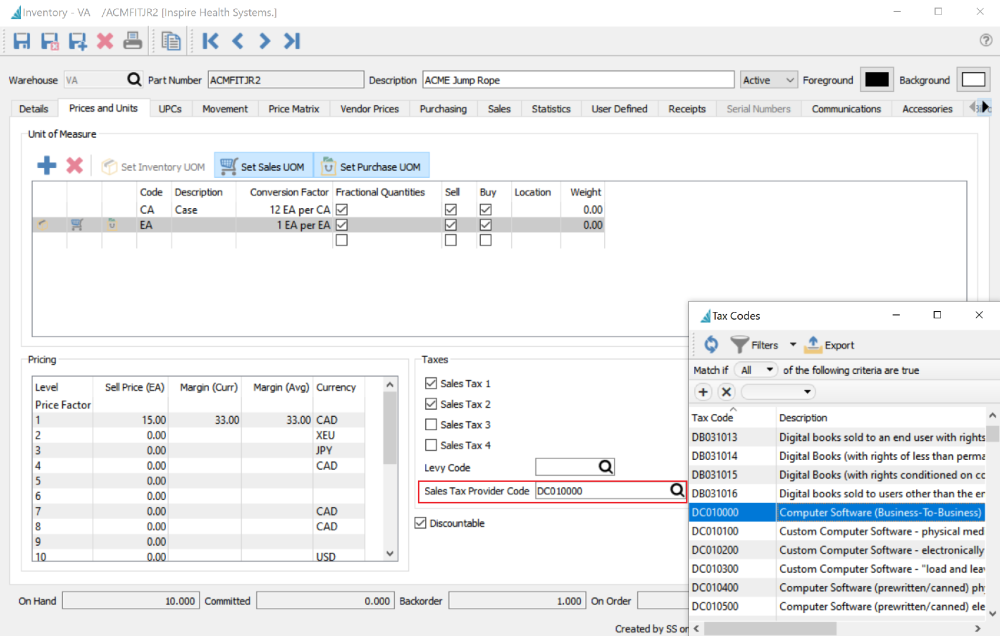

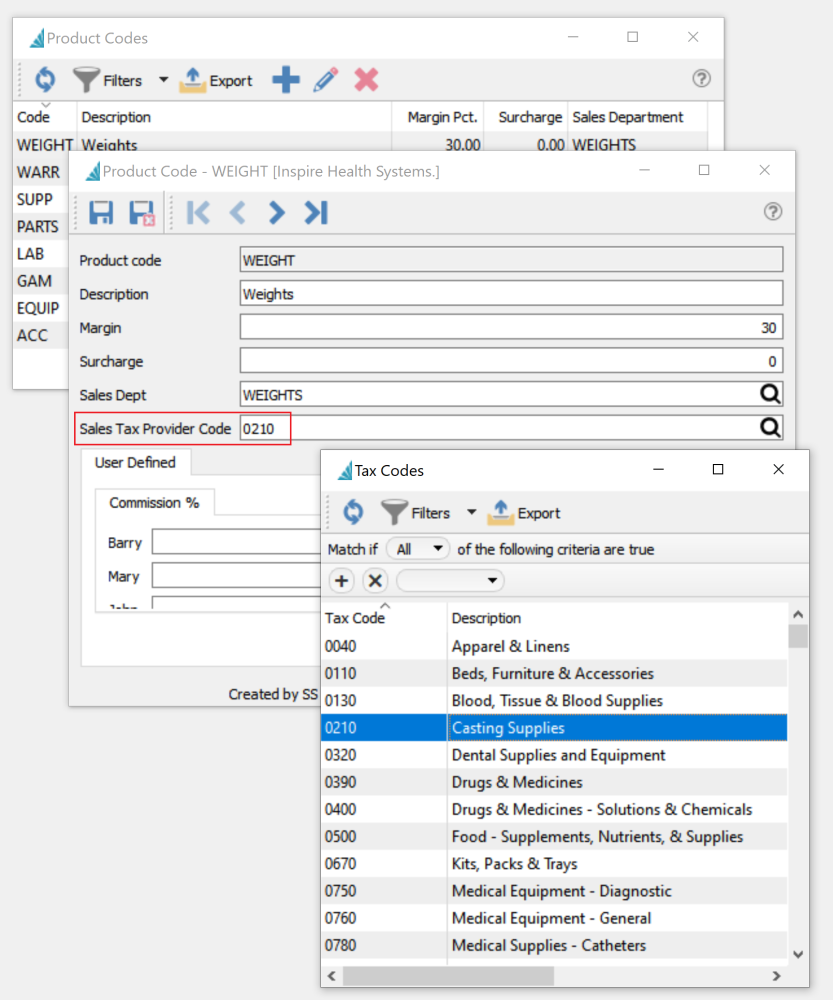

TaxCode the Avalara Product Tax code for the variant.

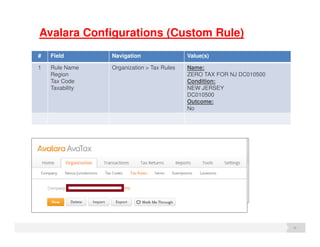

. This tax code is only to be used to trigger colorados 027 retail delivery fee. Find the Avalara Tax Codes also called a goods and services type for what you sell. Avalara Tax Research 3 min.

Avalara will use Store Location mailing addresses to determine tax rates. AvaTax System Tax Codes in blue font. The most common place to map an item to a tax code is the place where you maintain your master inventory list which is typically in your business application.

Select Custom Tax Codes and then select Add a Custom Tax Code. Avalara tax code matrix Thursday. If you must map more than 100000 SKU codes to.

Enter the details for your custom tax code including the type the code and a description. Avalara MatrixMaster makes it easy. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Map the items you sell to Avalara tax codes Avalara Connector for NetSuite 7 min FREE. Avalara Tax Research Standard. These tax codes are.

You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. Find the Avalara Tax Codes also called a goods and services type for what you sell. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

With a powerful database of over 15 million codes Avalara MatrixMaster is the worlds largest database of Universal Product Codes UPC with. If Avalara is unable to validate a mailing address Avalara will use the tax rates applicable to the ZIP code for such. Simplify your research solution with access to a QA database and dedicated tax.

All rights reserved Terms and Conditions. Content is shown for. P0000000 and U0000000.

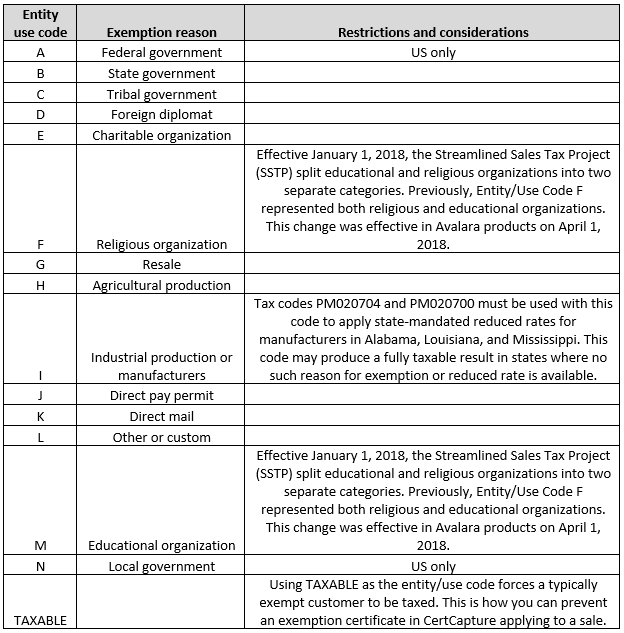

AvaTax System Tax Codes AvaTax System Tax Code AvaTax System Tax Code Description Additional AvaTax System Tax Code Information Note. Find the right Avalara tax codes for your products and services. Setup 5 of 9.

Its important to note that there is a maximum of 100000 items per import. Items in AvaTax should have both a tariff code and a tax code to. 25 of 10000 2500.

The 027 fee will automatically be calculated when this tax. Build a Matrix Avalara Tax Research 2 min FREE. The tax code should be passed with a 0 line amount.

After youve reviewed the tax. You can copy and paste a code you find here into the Tax Codes field in. Use a self-service research tool to help find the tax answers you need.

Upload a list of your products so Avalara can make tax code recommendations. 2022 Avalara Inc.

Set Up Avatax Connector For Salesforce Sales Cloud For Your Tax Calculation Needs Avalara Help Center

Avalara Announces Low Code Developer Tools And New Apis To Embed Compliance Into Business Applications And Ecommerce Platforms

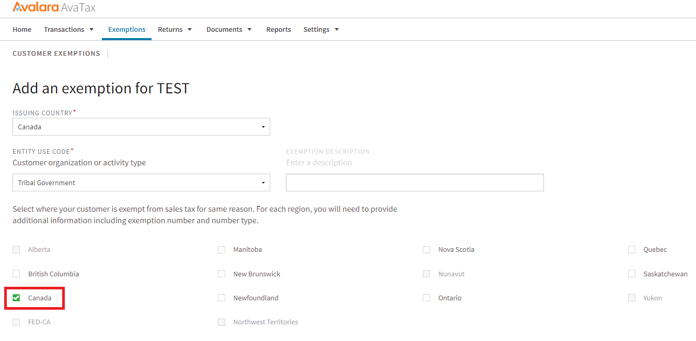

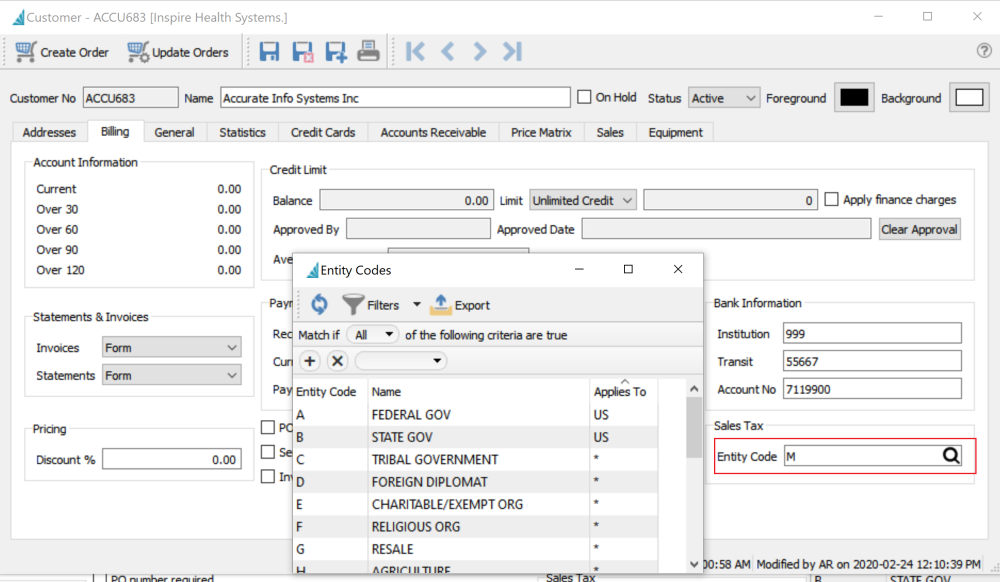

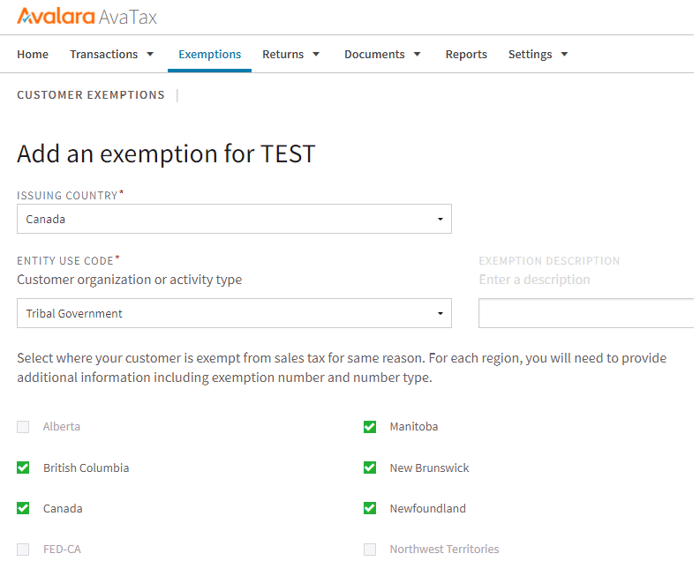

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Subscription Software Integration With Avalara Subscriptionflow

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

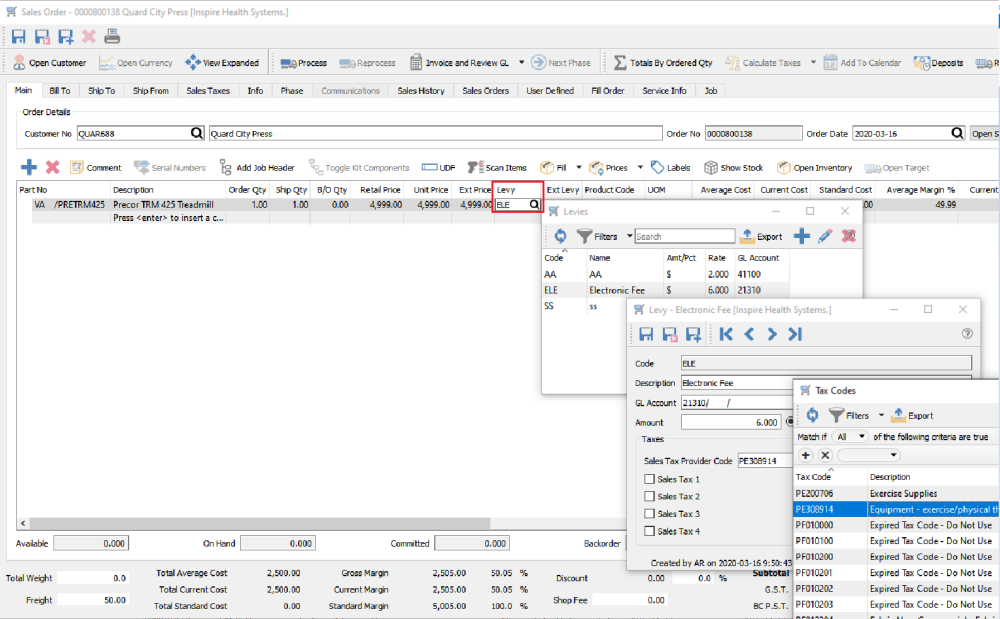

Avalara Sales Tax Spire User Manual 3 5

Avalara Interview Questions Avalara Coding Interview Questions

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Avalara Sales Tax Spire User Manual 3 5

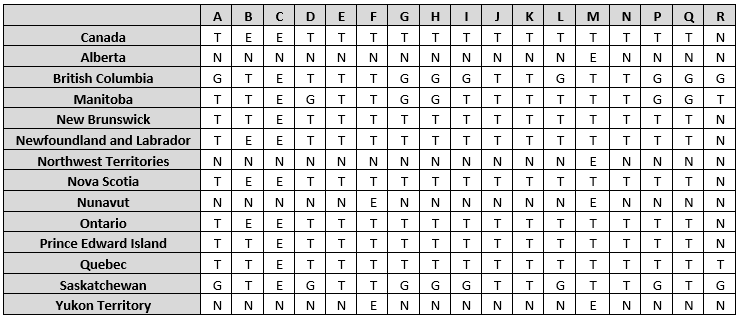

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Understanding Freight Taxability Avalara Help Center

Avalara Sales Tax Spire User Manual 3 5

Subscription Software Integration With Avalara Subscriptionflow