nj 529 plan tax benefits

Web A key benefit of both NJ 529 plans is the NJBEST Scholarship. LinkedIn StumbleUpon Google Cancel.

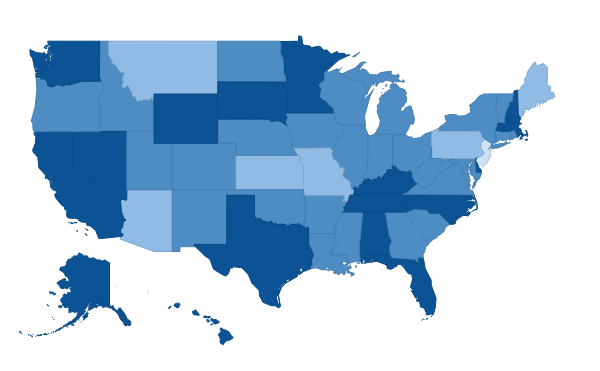

529 Tax Deductions By State 2022 Rules On Tax Benefits

The Vanguard 529 College Savings Plan is a Nevada Trust administered by.

. Five years worth of gifts up to 80000 for an. Web For example New York residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married filing jointly. A 529 plan is designed to help save for college.

As of January 2019 there are no tax deduction benefits when. There are 249350 registered schools in. Web Other state benefits may include financial aid scholarship funds and protection from creditors.

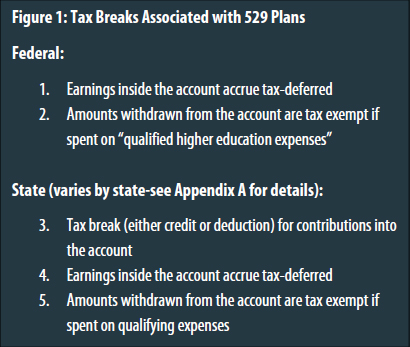

Tax savings is one of the big benefits of using a 529 plan to save for college. Web Section 529 - Qualified Tuition Plans. However Indiana Utah and Vermont offer a state income tax.

Web Beginning in tax year 2022 New Jersey will join its peers in allowing a state income tax deduction of up to 10000 per taxpayer with a gross income of 200000 or. Unlike traditional IRAs and 401 ks 529 plan contributions are not tax deductible at the federal level. Web Tax Deductions for New Jersey Families.

Web New Jersey 529 Plan Tax Information. On a federal-level there is no tax savings for contributions but. Web New Jerseys plan doesnt offer much.

New Jersey Tax Benefits. Franklin Templeton 529 College. Plan data as of 052919.

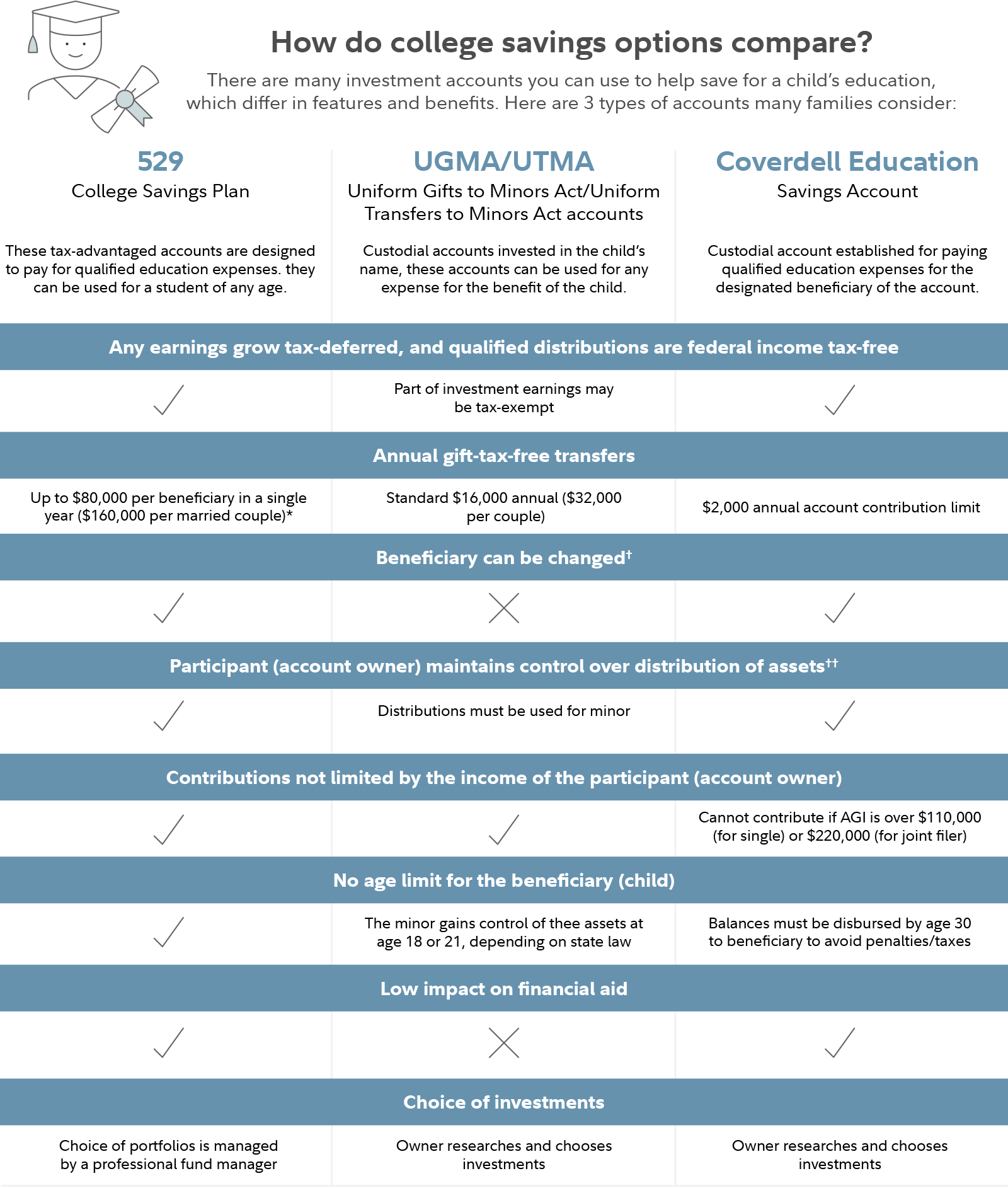

Contributions to such plans are not deductible but the money grows tax-free. Web New Jersey 529 Plans. Web 36 rows The most common benefit offered is a state income tax deduction for 529 plan contributions.

It offers New Jersey residents. Web New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along. The NJBEST Scholarship is not need-based.

Web New Benefits For New Jersey Residents. NJBEST 529 College Savings Plan offers a flexible. New Jersey 529 Plan Statistics.

Web New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Web Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to. This state does not offer any tax.

Either the child or the account owner must be a NJ resident. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you. Web Plan Highlights New Jersey Benefits 10 More Things You Should Know.

The plan NJBEST is offered through Franklin Templeton. Web NJBEST 529 College Savings Plan. Web The NJBEST 529 College Savings Plan is a direct-sold plan that comes with 014 081 fees and requires in-state residency.

NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student. NJBEST New Jerseys 529 College Savings Plan.

529 Plans Which States Reward College Savers Adviser Investments

Hawaii 529 Plans Learn The Basics Get 30 Free For College Savings

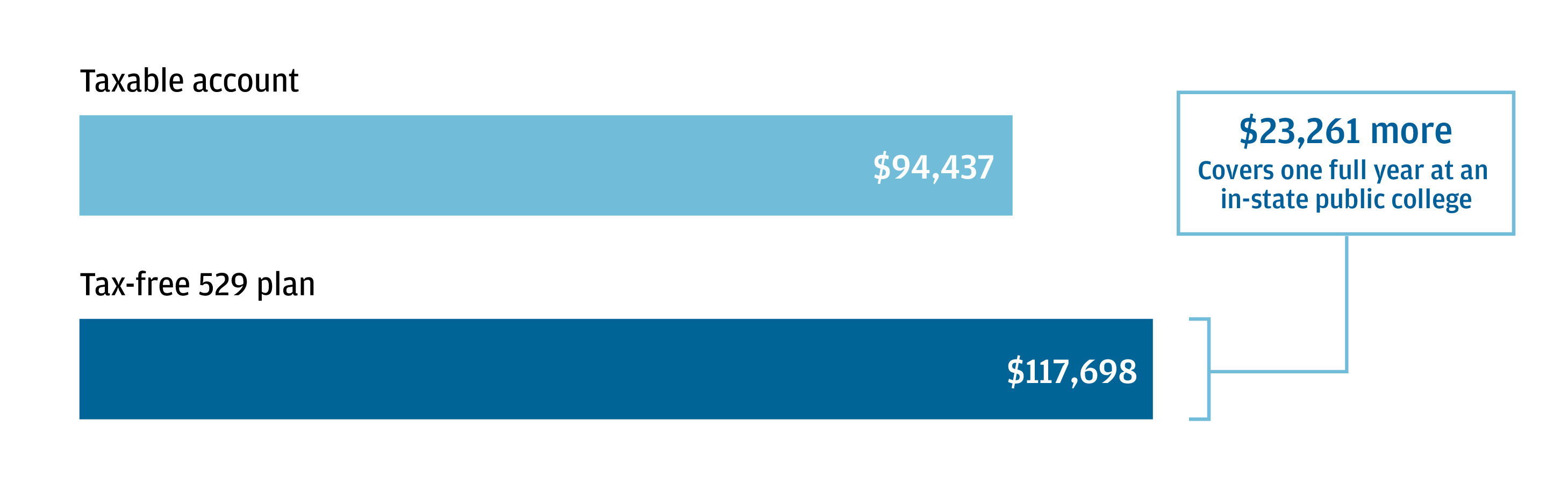

How Much Are 529 Plans Tax Benefits Worth Morningstar

529 Plan Tax Benefits J P Morgan Asset Management

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

Tax Benefits Nest Advisor 529 College Savings Plan

Tax Cuts And Jobs Act 529 Plans Expanded

Does Your State Offer A 529 Plan Contribution Tax Deduction

529 Tax Benefits The Education Plan

New Tax Breaks For Nj College Students Senior Citizens What To Know

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

Retirement Vs College How Much Should I Save Money

How Much Are 529 Plans Tax Benefits Worth Morningstar

The Top 9 Benefits Of 529 Plans Savingforcollege Com

:max_bytes(150000):strip_icc()/GettyImages-647056058-bba8ec5a5fc541159b733ff927048889.jpg)

Best 529 Plans For College Savings

Determining How Much To Contribute To A 529 Plan Not Too Much